Bonds - The price of a bond (part 1)

Level: Beginner / Length: 7 minutes

This module is part one of two on the topic of the price of bonds. The course is the beginning of our exploration of bond trading in the secondary market.

This ‘secondary market’ is the place in which all bonds trade once the initial primary market issue has taken place. It is in this secondary market that the price of a bond is important for bond investors. We need to understand the quoted price for a bond known as the clean price. And in this first topic we begin by showing you how to calculate the cash equivalent of the clean price of the bond. We’ll also explain why the investor pays the ‘dirty price’ for a bond rather than just the clean traded price.

We’ll look at:

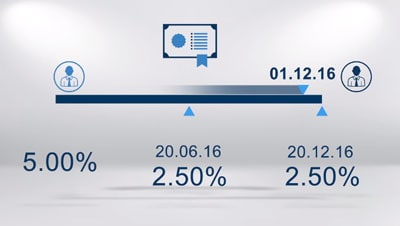

- The price of a bond is a percentage. What does this mean?

- Trading the ‘clean’ price of a bond

- Coupon accruals

- The invoice or ‘dirty price’ of a bond