Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Global Head of Investment Strategy

Key points

The global EV market is evolving rapidly in 2025, with intensifying competition and stricter government regulations reshaping the landscape. As automakers compete for dominance, the Chinese EV maker BYD has solidified its position as a major force, challenging both legacy brands and Tesla through affordability, innovation, and strategic expansion.

But can BYD maintain its lead? And more importantly, can it translate market share gains into long-term profitability? Investors need to assess whether BYD’s strategy of aggressive pricing and mass adoption will hold up against growing geopolitical pressures, intensifying competition, and the need for sustained margins.

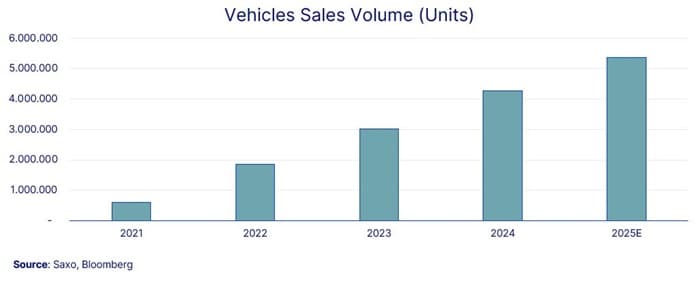

BYD has cemented itself as a dominant force in the EV market, surpassing Tesla in total new energy vehicle (NEV) sales. In 2024, BYD delivered 4.27 million NEVs, a 41% year-over-year increase, significantly outpacing Tesla’s 1.84 million BEVs, and positioning the company as the eighth-largest automaker in the world by total sales.

Its dominance is particularly evident in China, where it remains the largest EV manufacturer, accounting for 50% of all electrified vehicle sales. BYD’s key advantage lies in its vertically integrated supply chain, producing its own batteries, semiconductors, and electric drivetrains—reducing costs and boosting margins. Unlike Tesla, which relies on suppliers for key components, BYD’s in-house production enables pricing flexibility and rapid scalability.

The company has also ramped up global expansion, with exports soaring 83% year-over-year in early 2025. Its footprint is growing in Southeast Asia, Latin America, and the Middle East, though trade barriers in Europe—such as the EU’s 17% tariff on Chinese EVs—pose challenges.

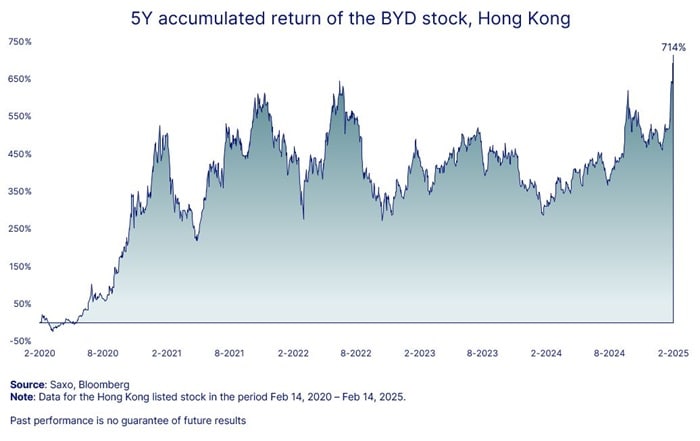

BYD’s stock has delivered a 714% return over the past five years, with a 36% gain in 2025, reflecting strong investor confidence. With a market cap exceeding USD 132 billion, it is now worth more than Ford, GM, and Stellantis combined.

Despite this, BYD remains far cheaper than Tesla. The stock trades at a forward P/E ratio of around 20x, close to its two year average, whereas Tesla commands a staggering almost 120x multiple. The stark difference comes down to how investors view the two companies—Tesla is seen as a technology and AI-driven company, with future revenue tied to autonomous driving, AI-powered mobility, and software subscriptions. BYD, on the other hand, is viewed as a cost-efficient manufacturing giant, focused on affordability and production scale.

Compared to Chinese EV peers, BYD trades at a moderate premium, reflecting its market dominance and cost leadership, but it remains within a historically stable valuation range. Unlike other Chinese EV companies that are burning cash in price wars, BYD’s vertical integration and cost control help sustain its profitability, making it a more reliable long-term bet. The key question is whether BYD can continue scaling while improving margins or if it will need to develop software-based revenue streams to unlock a higher valuation.

Expansion beyond China

BYD is aggressively scaling its international presence, with exports growing 83% year-over-year. It has gained significant traction in Southeast Asia, Latin America, and the Middle East, though European expansion faces challenges due to rising trade barriers, including the EU’s 17% tariff on Chinese EVs.

Aggressive pricing strategy

BYD’s low-cost approach is disrupting the industry. Models like the USD 10,000 Seagull hatchback and USD 21,600 Atto 3 SUV undercut competitors, forcing rivals into price wars. While this strategy has driven massive sales growth, it also puts pressure on profit margins.

Smart-driving technology & AI integration

BYD is making advanced driver assistance standard by offering its “God’s Eye” system—which includes hands-free highway driving, automatic braking, and parking assistance—as a standard feature on most models. Unlike Tesla, which monetises its Full Self-Driving (FSD) software through a subscription (USD 99/month) or an upfront fee (USD 8,000), BYD has chosen to absorb the cost to accelerate market adoption.

While Tesla generates revenue through its FSD software, BYD is prioritising market expansion by including driver-assistance features without additional charges. This move strengthens its competitive edge but also represents a strategic investment that could impact short-term profitability.

Currently, Tesla’s FSD remains more advanced, capable of handling a broader range of driving tasks. However, BYD is rapidly enhancing its system, and the integration of DeepSeek AI is expected to improve vehicle perception, navigation, and automation capabilities, further increasing competition in the space.

BYD’s combination of scale, affordability, and innovation presents major growth opportunities, but it also faces increasing challenges as it expands globally.

Opportunities

Challenges

Investor takeaways: Is BYD a long-term winner?

BYD has established itself as a global EV powerhouse, combining cost leadership, scale, and vertical integration to dominate the industry. Its pricing strategy and aggressive expansion have driven massive sales growth, but the company must now prove that it can sustain strong margins and global competitiveness.

With 5–6 million EV sales projected for 2025, BYD’s ambitions are clear. If it navigates trade challenges and price competition effectively, it could cement itself as the world’s leading EV manufacturer. However, whether it can transition from a volume leader to a high-margin player generating long-term shareholder value remains the ultimate test.