Quarterly Outlook

Fixed Income Outlook: Bonds Hit Reset. A New Equilibrium Emerges

Althea Spinozzi

Head of Fixed Income Strategy

Key points:

-----------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: US Jobs Report (Sep), Mainland China market holidays

Earnings: Duckhorn

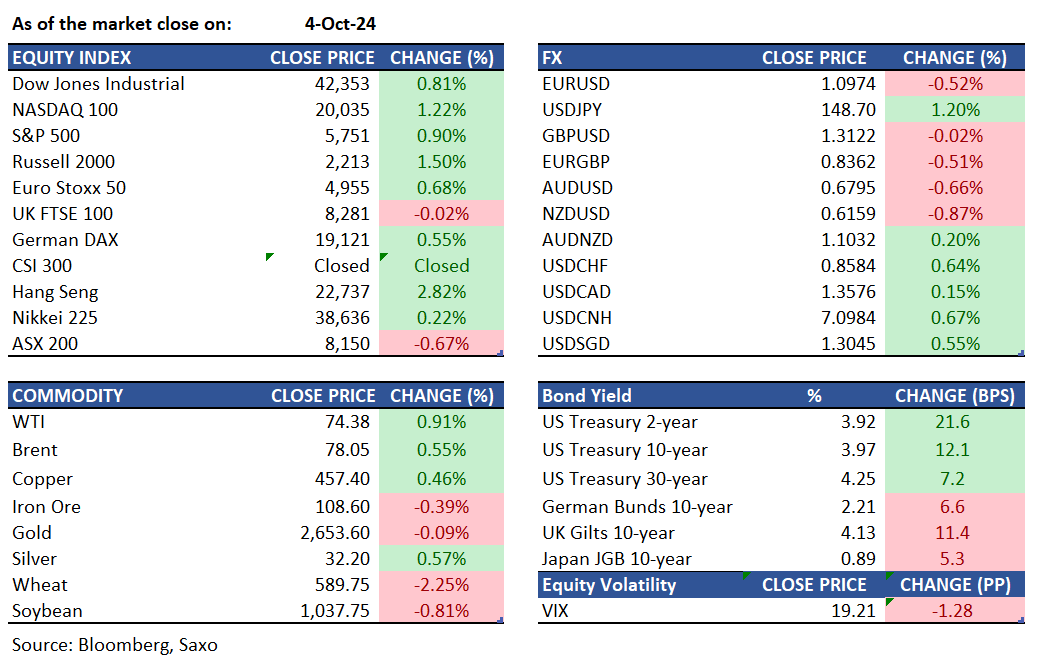

Equities: US equities closed higher on Friday after a surprisingly strong jobs report. The S&P 500 rose by 0.9%, the Nasdaq 100 gained 1.2%, and the Dow Jones set a new record with a 341-point increase. The September jobs report revealed the labor market added 254K jobs, exceeding expectations of 150K, and the unemployment rate fell to 4.1% from 4.2% in August. This robust data supports Fed Chair Jerome Powell's view that the economy is "solid," suggesting the Federal Reserve is unlikely to cut interest rates by 50bps in the next meeting in November. The financial sector led the gains, with JP Morgan up 3.5%, Bank of America rising 2.2%, and Wells Fargo jumping 3.6%. Consumer discretionary stocks also outperformed, led by Tesla (3.9%) and Amazon (2.5%). Markets now look ahead to the latest Fed meeting minutes on Wednesday and the consumer price index report on Thursday to guide the Fed rate trajectory.

Fixed income: Treasuries plunged on Friday due to stronger-than-expected September jobs data, spurring heavy futures trading. Short-term yields soared over 20 basis points as expectations for further Federal Reserve rate cuts faded, leaving quarter-point moves anticipated for the next four meetings. Yields across maturities rose at least 9 basis points, surpassing 50-day moving averages. The 2-year note's yield jumped 22 basis points, its largest one-day rise since April. This selloff pushed yields to levels last seen in August or early September, flattening the 2s10s and 5s30s curve spreads. Following the jobs report, Bank of America and JPMorgan revised their forecasts. Leveraged funds also reduced their net short positions in bond futures, according to the CFTC’s Commitments of Traders report.

Commodities: WTI crude oil futures increased by 0.9% to close at $74.38, while Brent crude oil futures rose by 0.5% to settle just above $78.05, marking a five-week high. These gains were driven by concerns over potential supply disruptions in the Middle East. However, oil prices later trimmed their gains after President Biden indicated he might consider alternatives to Israel striking Iran's oil fields, following his earlier reluctance to condemn Israel's potential actions directly. Gold prices dipped by 0.43% to $2,667.80, pressured by a stronger U.S. dollar after a robust September jobs report, although gold remains strong overall. Meanwhile, silver prices surged past $32.2, reaching a 12-year high. This increase is attributed to heightened demand for safe-haven assets and bullish expectations for silver’s industrial use, fueled by China's economic stimulus measures.

FX: USD surged to a seven-week high on Friday, poised for its best week since September 2022, following a robust September jobs report that led traders to reduce expectations of further 50-basis-point rate cuts by the Federal Reserve. The US Dollar also marked its strongest weekly performance against the Japanese yen since 2009, driven by a less dovish Fed and a more dovish Bank of Japan. U.S. nonfarm payrolls rose by 254,000, surpassing the anticipated 140,000, and the unemployment rate dropped to 4.1%. Karl Schamotta of Corpay noted that this "blockbuster payrolls report" makes a no-landing scenario for the U.S. economy more plausible, suggesting the Fed will be more cautious in easing policy. Improved economic data and hawkish remarks from Fed Chair Jerome Powell led traders to eliminate bets on a 50-basis-point cut at the upcoming Fed meeting, now favoring a 25-basis-point reduction or no change at all.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.

Disclaimer

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Please read our disclaimers:

- Notification on Non-Independent Investment Research (https://www.home.saxo/legal/niird/notification)

- Full disclaimer (https://www.home.saxo/en-gb/legal/disclaimer/saxo-disclaimer)