Quarterly Outlook

Fixed Income Outlook: Bonds Hit Reset. A New Equilibrium Emerges

Althea Spinozzi

Head of Fixed Income Strategy

Key points:

-----------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: US Jobs Report (Sep), Mainland China market holidays

Earnings: Duckhorn

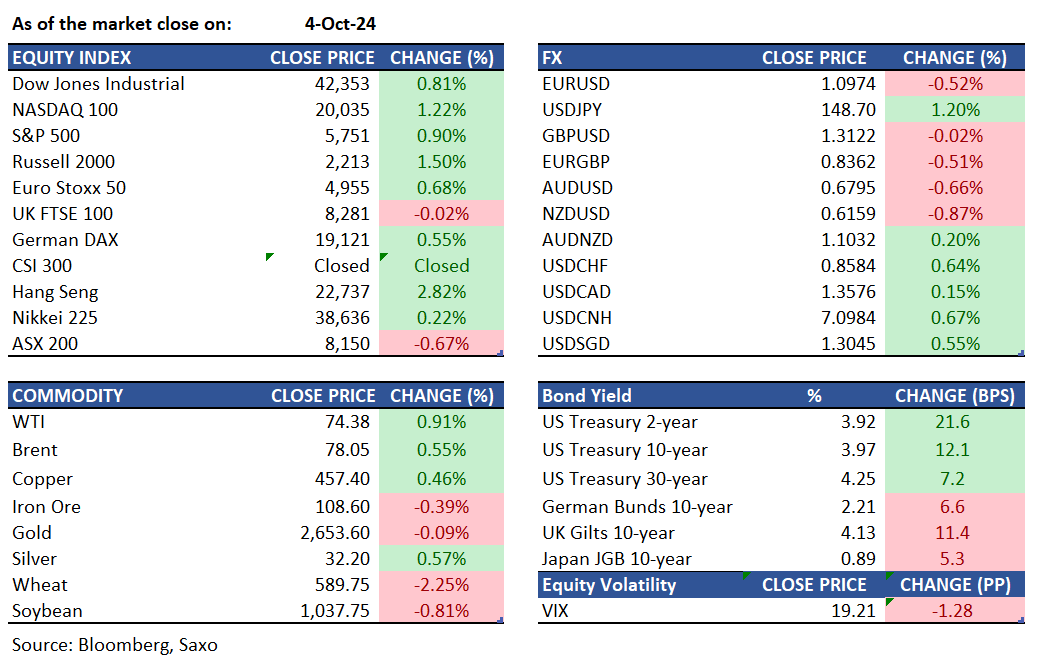

Equities: US equities closed higher on Friday after a surprisingly strong jobs report. The S&P 500 rose by 0.9%, the Nasdaq 100 gained 1.2%, and the Dow Jones set a new record with a 341-point increase. The September jobs report revealed the labor market added 254K jobs, exceeding expectations of 150K, and the unemployment rate fell to 4.1% from 4.2% in August. This robust data supports Fed Chair Jerome Powell's view that the economy is "solid," suggesting the Federal Reserve is unlikely to cut interest rates by 50bps in the next meeting in November. The financial sector led the gains, with JP Morgan up 3.5%, Bank of America rising 2.2%, and Wells Fargo jumping 3.6%. Consumer discretionary stocks also outperformed, led by Tesla (3.9%) and Amazon (2.5%). Markets now look ahead to the latest Fed meeting minutes on Wednesday and the consumer price index report on Thursday to guide the Fed rate trajectory.

Fixed income: Treasuries plunged on Friday due to stronger-than-expected September jobs data, spurring heavy futures trading. Short-term yields soared over 20 basis points as expectations for further Federal Reserve rate cuts faded, leaving quarter-point moves anticipated for the next four meetings. Yields across maturities rose at least 9 basis points, surpassing 50-day moving averages. The 2-year note's yield jumped 22 basis points, its largest one-day rise since April. This selloff pushed yields to levels last seen in August or early September, flattening the 2s10s and 5s30s curve spreads. Following the jobs report, Bank of America and JPMorgan revised their forecasts. Leveraged funds also reduced their net short positions in bond futures, according to the CFTC’s Commitments of Traders report.

Commodities: WTI crude oil futures increased by 0.9% to close at $74.38, while Brent crude oil futures rose by 0.5% to settle just above $78.05, marking a five-week high. These gains were driven by concerns over potential supply disruptions in the Middle East. However, oil prices later trimmed their gains after President Biden indicated he might consider alternatives to Israel striking Iran's oil fields, following his earlier reluctance to condemn Israel's potential actions directly. Gold prices dipped by 0.43% to $2,667.80, pressured by a stronger U.S. dollar after a robust September jobs report, although gold remains strong overall. Meanwhile, silver prices surged past $32.2, reaching a 12-year high. This increase is attributed to heightened demand for safe-haven assets and bullish expectations for silver’s industrial use, fueled by China's economic stimulus measures.

FX: USD surged to a seven-week high on Friday, poised for its best week since September 2022, following a robust September jobs report that led traders to reduce expectations of further 50-basis-point rate cuts by the Federal Reserve. The US Dollar also marked its strongest weekly performance against the Japanese yen since 2009, driven by a less dovish Fed and a more dovish Bank of Japan. U.S. nonfarm payrolls rose by 254,000, surpassing the anticipated 140,000, and the unemployment rate dropped to 4.1%. Karl Schamotta of Corpay noted that this "blockbuster payrolls report" makes a no-landing scenario for the U.S. economy more plausible, suggesting the Fed will be more cautious in easing policy. Improved economic data and hawkish remarks from Fed Chair Jerome Powell led traders to eliminate bets on a 50-basis-point cut at the upcoming Fed meeting, now favoring a 25-basis-point reduction or no change at all.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.