Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Macro events: IMF World Economic Outlook; ECB's Lagarde, Holzmann, Knot, Centeno; BoE's Greene, Bailey, Breeden; Fed's Harker.

Earnings: Verizon, General Motors, RTX, 3M, Lockheed Martin, Texas Instruments

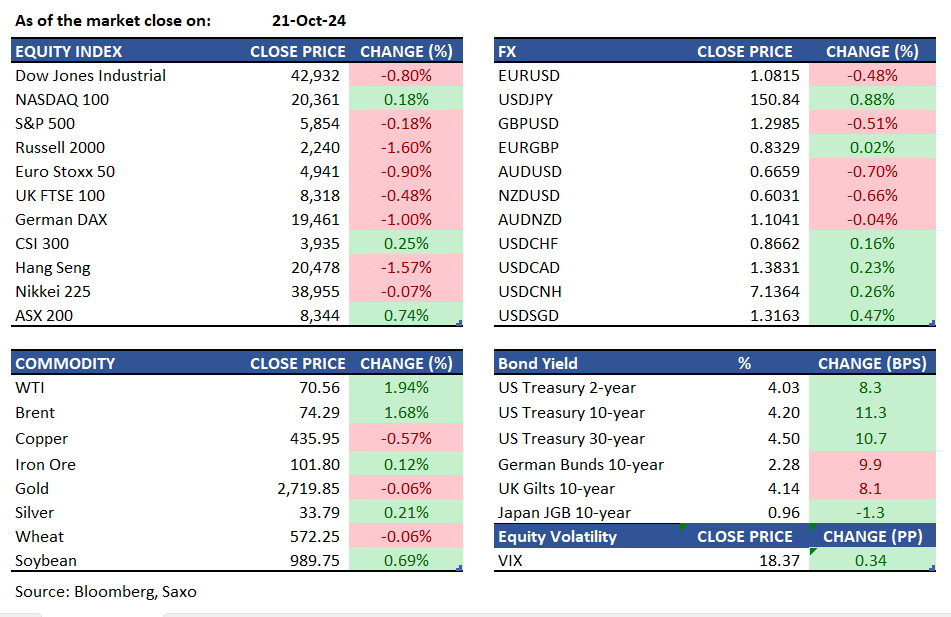

Equities: On Monday, most US stocks declined after their longest weekly rally of the year, as investors geared up for a week filled with earnings reports while rising Treasury yields has negatively affected consumer and homebuilder stocks. The S&P 500 fell by 0.2%, the Dow Jones dropped 344 points, while the Nasdaq 100 edged up 0.2%. Treasury yields surged, with the 10-year yield reaching 4.18%, sparking concerns about potential inflation and fiscal spending pressures with Trump continuing to lead the polls in online betting sites. Homebuilder stocks and megacaps pulled back, although Nvidia outperformed, rising by 4.1% to a record high. Tesla's stock fell by 0.8% amid market anticipation for its earnings report due tomorrow, despite disappointment over its recent robotaxi reveal. Boeing shares rose by 3.1% following news of a tentative union agreement.

Fixed income: Treasuries declined during the US session, pushing 10-year yields up by as much as 10 basis points, influenced by a selloff in European bonds, rising oil futures, and a stronger US dollar. Yields were higher by up to 9.5 basis points for intermediate maturities, with the 2s10s yield spread steepening by 2 basis points. US 10-year yields were around 4.18%, reflecting similar trends in the German bond market, while Italian bonds underperformed, with yields about 6 basis points higher than Treasuries. The swaps market priced in 39 basis points of easing over the next two policy meetings, down from 42 basis points at Friday's close.

Commodities: WTI crude oil futures increased by 1.94% to over $70.56, and Brent crude oil futures rose by 1.68% to $74.29, influenced by Middle East tensions and China's economic stimulus measures. Geopolitical risks have escalated due to conflicts involving Israel, Hezbollah, and Iran. Gold prices are around $2,720, while silver surged to nearly $34, its highest in almost 12 years, driven by US election uncertainties, Middle East tensions, and expectations of further monetary easing. Silver's demand is also bolstered by its use in solar panels amid the global shift towards cleaner energy. US natural gas futures climbed by about 3% to over $2.3/MMBtu, recovering from a 14.2% drop last week, due to lower production and cooler weather forecasts increasing heating demand.

FX: The key story of the day was higher yields as markets continues to push back on expectations of aggressive Fed easing and also tilted towards pricing in a Trump 2.0. We discussed the top 10 questions that investors have ahead of the US elections in this article. This pushed the US dollar higher across the board, and losses were led by the Japanese yen – the currency that is the most sensitive to yields. The yen pushed back above 150 against the US dollar, and there could be risks of a verbal intervention from Japanese authorities. Activity currencies like Australian dollar, kiwi dollar and the British pound all fell by over 0.5% against the US dollar, while Swiss franc outperformed. The euro revisited its lowest levels since August, and ECB President Lagarde will be on the wires later today. The offshore Chinese yuan traded back above 7.13 against the US dollar, wiping out Friday’s gains, amid strength in the greenback and China’s policy easing measures.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.