Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Chief Macro Strategist

Macro backdrop

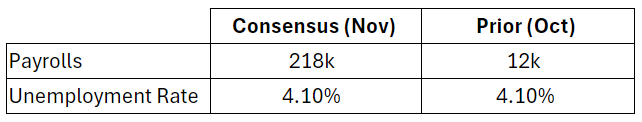

October's Non-Farm Payroll (NFP), which recorded an increase of just 12,000—marking its lowest since December 2020—was affected by disruptions caused by Hurricanes Helene and Milton, Boeing strikes, layoffs in the automotive industry, and slow hiring in the professional services sector. The return of Boeing workers following the strike may temporarily contribute approximately 40,000 jobs, resulting in a slight increase in November's Non-Farm Payroll. Nevertheless, this growth is not expected to completely offset the downturn caused by the hurricanes. The unemployment rate might unexpectedly fall as the labor force significantly recovers from the disruptions in October (bad weather and labor strikes).

Non-Farm Payrolls (Expected in Green, Actual in Red)

Source: Bloomberg

Price action

Last month, treasury yields experienced considerable fluctuations as a result of the weak NFP, initially decreasing before swiftly climbing, notably for the 10-year yield, which led to a steepening of the yield curve. The USD initially declined following the weak NFP data but climbed in the ensuing days as the market began to anticipate a Trump victory with the election occurring shortly after the NFP announcement. Over the last two years, EURUSD has demonstrated a notable inverse correlation of -0.7 with the 10-year yield based on monthly data and is one of the most reactive pairs on key US data. The three-month implied volatility has recently risen to 8.26%, marking its highest level since March 2023, amid concerns over the potential collapse of the French government.

Trade Inspiration

Bear call spread:

A vertical spread strategy involving two call options with the same expiration date but different strike prices, where the short call has a lower strike price than the long call, resulting in an initial net credit of about 100 pips. Buy a call option with the higher strike of 1.06 (recent resistance) and sell a call option with a lower strike of 1.04 (recent support). Example based on 100k notional:

-Maximum gain: The net premium received is $1,088.

-Maximum loss: The difference between the high strike and the low strike, minus the net premium received is $912.

-Breakeven point: The short call strike plus the net credit received is 1.0508.