Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Sales Trader

Summary: Nvidia's stock has rebounded significantly, surging 22% from a recent low and adding nearly $480 billion in market capitalization. Despite a recent significant drop in stock value, Nvidia remains dominant in the market for data center accelerators driving complex AI-related tasks. Investors with a long-term stake in Nvidia can consider reducing risk while maintaining exposure by selling Nvidia stock and purchasing an equivalent exposure of call options on Nvidia. This strategy allows for retaining exposure to Nvidia while reducing capital outlay and risk, offering limited risk, leverage, and potential for asymmetrical gains, but also subject to the risks associated with options trading.

What is happening with Nvidia?

Nvidia's stock rebounded from a selloff two weeks ago, surging 22% from the recent low of $756 and adding nearly $480 billion in market capitalization. The rally follows major AI investments pledged by key clients such as Meta, Alphabet and Microsoft that amount to billions of dollars

The move is a sharp reversal from the 10% drop on 19 April which was the shares' most significant decline in over four years. This was driven by worries that the excitement around chipmakers had exceeded the actual situation, particularly after Taiwan Semiconductor Manufacturing Co. revised its expansion outlook downward.

Nvidia still holds a dominant position in the lucrative market for accelerators that drive data centres handling complex AI-related computing tasks. The stock has experienced a substantial 239% increase in 2023 and has risen 89% year-to-date. Nvidia will release its earnings report on May 22 2024.

What can you do if you are long Nvidia?

Investors who have a long-term stake in Nvidia and looking to reduce risk while maintaining the same exposure in Nvidia can sell Nvidia stock and buy the equivalent exposure of call options on Nvidia. This strategy enables the investors to retain exposure to Nvidia while reducing capital outlay and risk.

Steps:

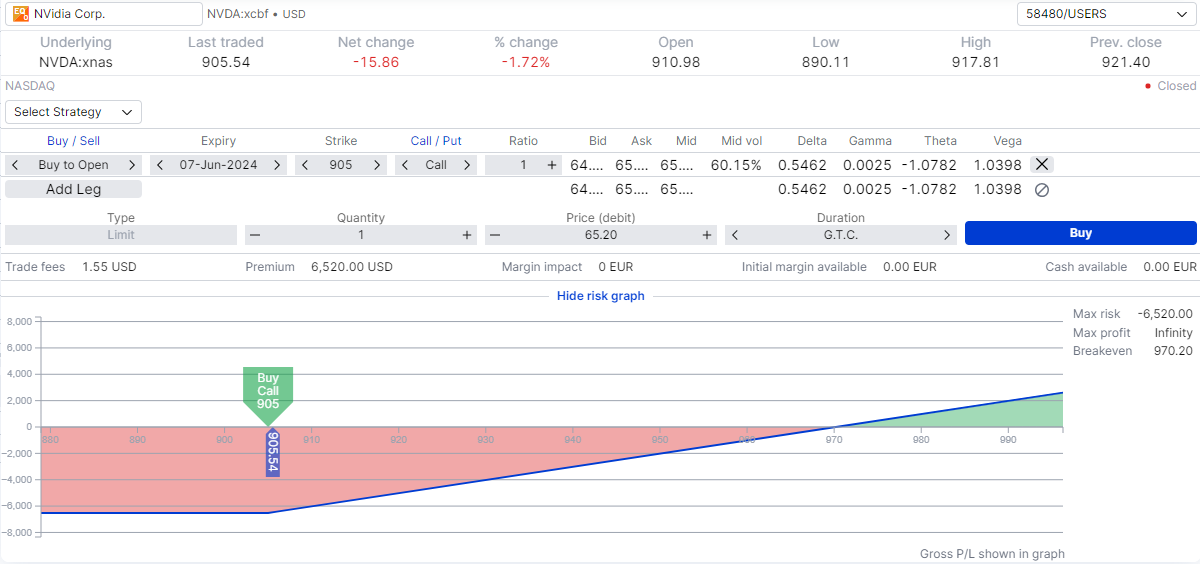

1. With Nvidia’s stock price at $905 on 7 May, sell 100 shares of Nvidia and received $90,500 ($905x 100 shares). Then, buy 1 unit of call options (100 shares) at the strike of $905 with 1-month expiry (7 Jun 2024), you paid a total premium of $6,545 ($65.45 x 100 shares).

2. Investor spends 7.2% ($6,545/$90,500) of the capital to maintain the same 100 shares of Nvidia exposure.

3. If Nvidia’s price rises above $905 strike price (in the money) at expiry, the investor may choose to exercise the right to buy 100 shares of Nvidia at $905 or sell to close the call option and take profit.

4. If Nvidia’s price rises during the course of the option, then the value of the option will also rise enabling investors to book profits if they believe the full upside of the stock is fully realized at any stage of the option tenure.

5. If Nvidia’s price falls below $905 strike price (out of the money) at expiry, the option may expire worthless, and the investor loses the total premium.

Advantages of long calls

1. Limited Risk. Investors can't lose more than the premium you paid for the option.

2. Leverage. With a small amount of money, you can gain a much larger exposure in the stock.

3. Potential for asymmetrical gains. If the stock price goes up, you can make the same amount of money with limited risk.

4. Flexibility. You can benefit from a stock's potential rise without having to buy the stock outright.

Risks of long calls

1. Long call options have a finite lifespan and will lose value over time, particularly if the stock price does not rise above your option strike. If the stock price does not rise above the option strike by expiry, the option will expire worthless.

2. Fluctuations in the stock price can increase the risk associated with long call options, leading to significant changes in the option's market to market value.

3. If the stock price doesn't go above the strike price before the option’s expiry, you might lose all the premium you paid for the option.

4. Long call options are also subject to the influence of macroeconomic factors that can impact stock prices, including interest rate movements, significant events, and major economic shifts.