Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Chief Macro Strategist

Introduction

TSMC, the world's largest contract chipmaker with customers like Apple and Nvidia, has benefited from the AI megatrend. However, the company faces challenges from U.S. government’s technology restrictions on China and uncertainty regarding President-elect Donald Trump's administration, which has threatened broad import tariffs. In Q3 last year, TSMC secured a 64% share of the global pure play foundry market, up from 62% in the previous quarter, further solidifying its lead over competitors.

Earnings consensus

On January 10, TSMC reported December 2024 revenue of NT$278.16 billion, up 0.8% from November 2024 and 57.8% from December 2023. The total 2024 revenue was NT$2,894.31 billion, a 33.9% increase from 2023.

TSMC will report its quarterly earnings on January 16 at 3 pm SGT. TSMC is expected to report a net profit of NT$377.95 billion ($11.21 billion) for the quarter ended December 31. This estimate compares to a net profit of NT$238.7 billion in the fourth quarter of 2023.

Price action/ Key levels

After hitting a low of $133.57 during the Japanese yen carry trade unwind, TSMC ADR stock rallied to around $200, reaching a new all-time high of $222.20 on January 6. However, on January 7, a major sell-off in the AI sector occurred following the announcement of a new AI diffusion regulation that would regulate chip exports from the U.S. markets, causing stocks like Nvidia and TSMC to tumble. TSMC ADR has done well in 2024, having rallied 94.5%.

Market Catalyst – How will the stock move post earnings?

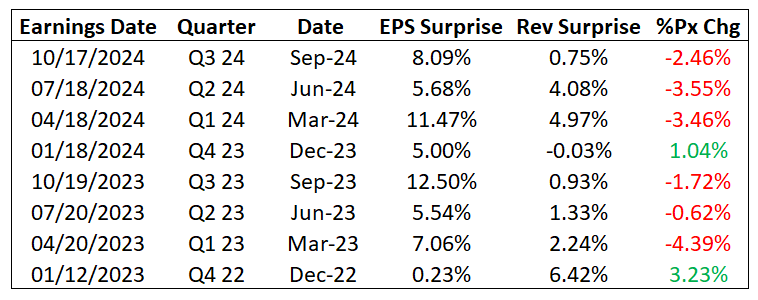

TSMC has surpassed earnings estimates for 12 consecutive quarters, highlighting its robust financial health and operational efficiency. The market also expects strong earnings guidance for the coming year. As reflected in the table below, market expectations for TSMC are high, and there are instances where, despite surpassing revenue and earnings targets, the stock may still decline on the day.

Trade Inspiration

TSMC stock chart has shown a strong upward trend over the past 2 years. The recent price action indicates a pullback from a peak, which could suggest a potential buying opportunity if the stock finds support around the current levels. The stock recently broke out from an 11-week ascending triangle on above-average volume but has since pulled back to retest the top trendline. Investors should watch for a bullish price target of $246 while keeping an eye on key support levels at $190 and $175 on TSMC's chart.

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

China Outlook: The choice between retaliation or de-escalation

Commodity Outlook: A bumpy road ahead calls for diversification