Key points:

- China’s Tech Stocks Are Back – Alibaba, Tencent, and Xiaomi saw a massive surge in trading activity, as investors rotated back into Chinese equities after months of selling. DeepSeek’s rise, Alibaba’s partnership with Apple, and better-than-expected earnings fueled the comeback.

- AI Growth Is Moving to Infrastructure – Super Micro Computer (SMCI) became the breakout winner, surging 293% in trading volume as investors shifted their focus from Nvidia and AI chips to AI server hardware and cloud infrastructure.

- Tesla Crashed, and Speculative Stocks Are Losing Steam – Tesla’s 28% drop was one of the biggest shocks of the month, reflecting concerns over slowing EV demand and intensifying competition. Meanwhile, quantum computing and clean energy stocks lost momentum, suggesting a shift away from speculative high-growth bets amid economic and geopolitical uncertainties.

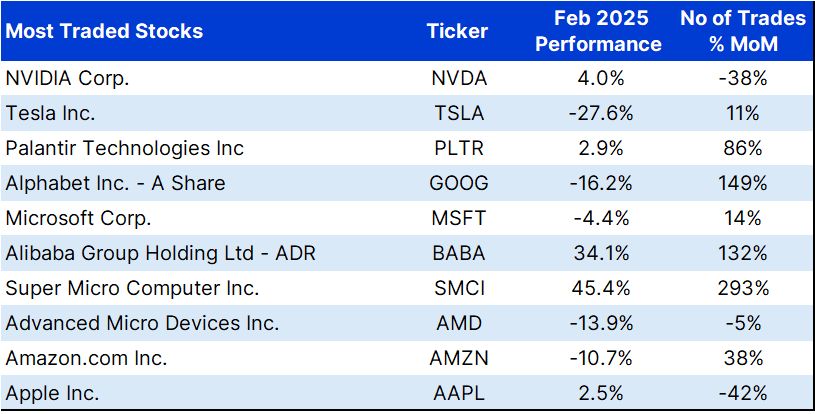

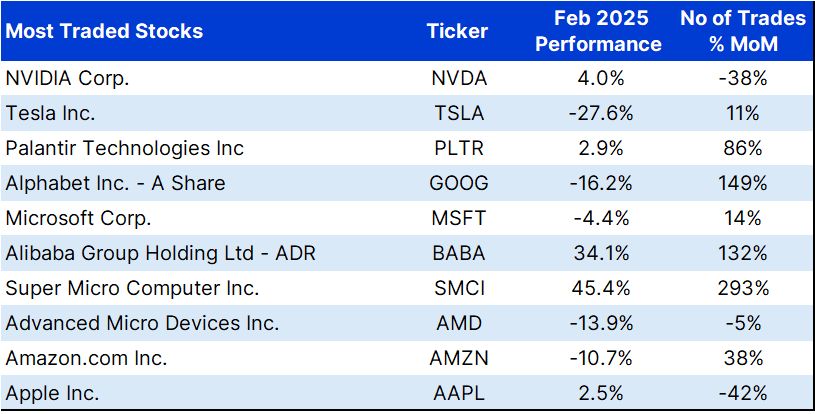

February’s Most Traded Stocks

February 2025 was a month of big shifts for Saxo’s Singapore clients. Chinese tech stocks surged, AI investors pivoted from chips to hardware, and Tesla took a major hit.

- Alibaba (BABA) jumped 34.1% and saw a 132% increase in trades, as investors rushed back into China’s beaten-down stocks after DeepSeek. Alibaba’s strategic partnership with Apple also underpinned, and Q4 earnings beat estimates.

- Super Micro Computer (SMCI) became the new AI favorite, soaring 45.4% with a massive 293% jump in trading volume, signaling a shift in AI investment focus from chipmakers to AI server hardware.

- Tesla collapsed 27.6%, despite an 11% increase in trades, as investors grew concerned about slowing EV demand and rising competition.

- Other notable moves included Nvidia (NVDA) gaining 4% but seeing a 38% drop in trading volume, indicating that traders may be rotating out of the AI chip leader. Meanwhile, Alphabet (GOOG) saw a 149% surge in trading despite falling 16.2%, as investors debated its role in the AI race.

- At the same time, quantum computing stocks collapsed, with Rigetti Computing (RGTI) and Quantum Computing Inc. (QUBT) seeing a steep drop in both trading volume and stock performance.

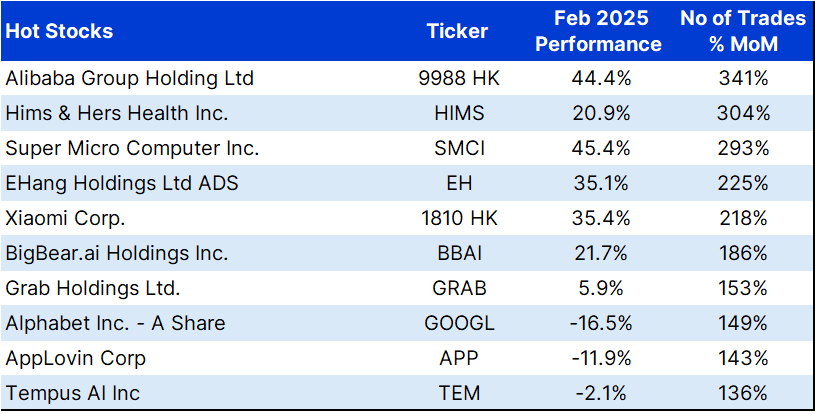

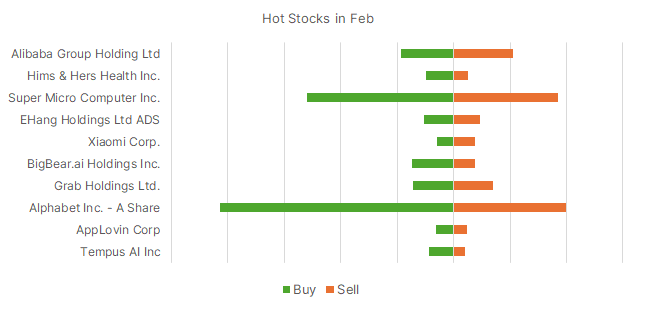

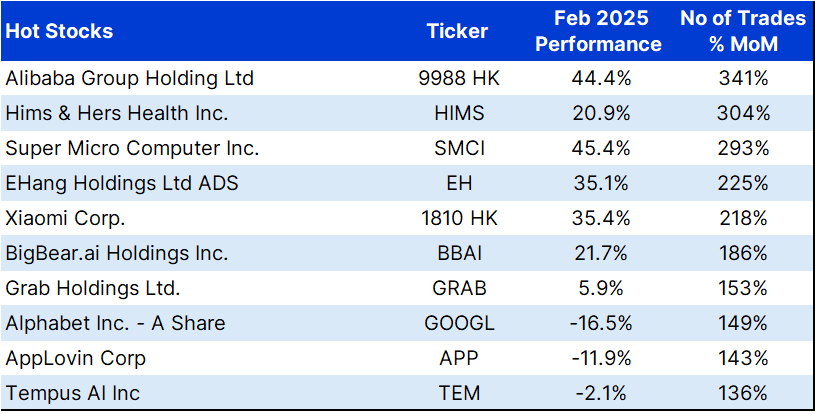

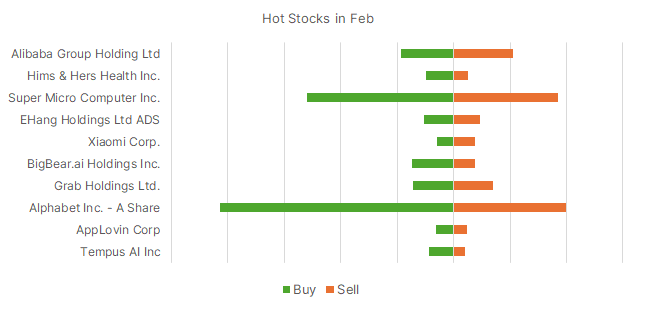

February’s Hot Stocks

Beyond the most traded names, several stocks saw a dramatic rise and fall in investor interest. We looked at the most traded stocks, which had more than 50 trades, and ranked their month-on-month change in trades. This helped us find the stocks that jumped the most in popularity, and those that lost steam. These stocks indicate our clients’ shifting interests, momentum and their read of the markets.

Key highlights for February’s hot stocks:

- Alibaba’s trading volume surged 341%, as traders bet on a Chinese tech revival.

- Super Micro Computer (SMCI) jumped 293%, reflecting the shift from AI software to hardware infrastructure.

- Hims & Hers Health (HIMS) exploded 304%, as healthcare tech became a new speculative target.

- BigBear.ai (BBAI) continued to see volatility, with a 186% increase in trading despite AI sentiment cooling elsewhere.

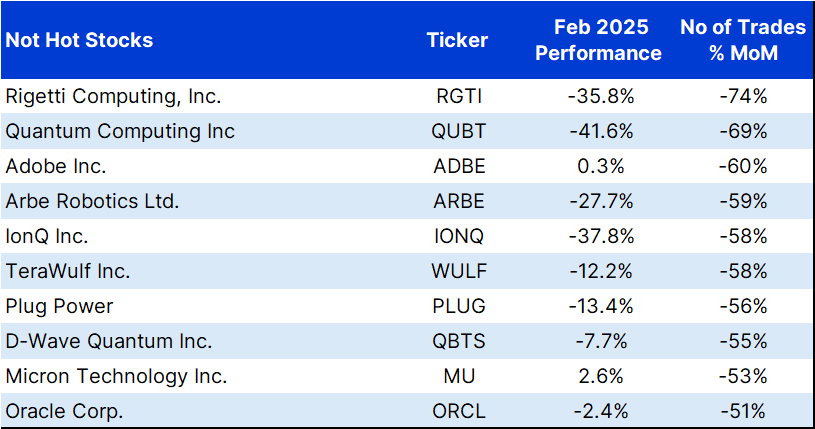

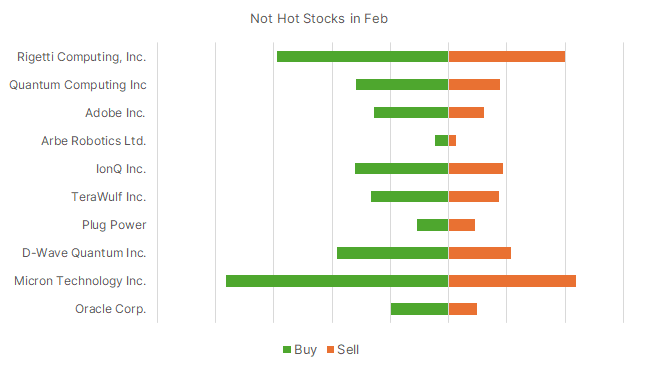

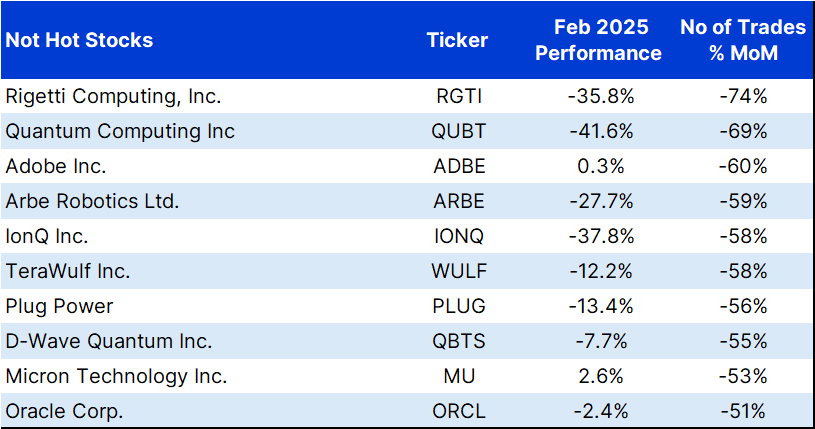

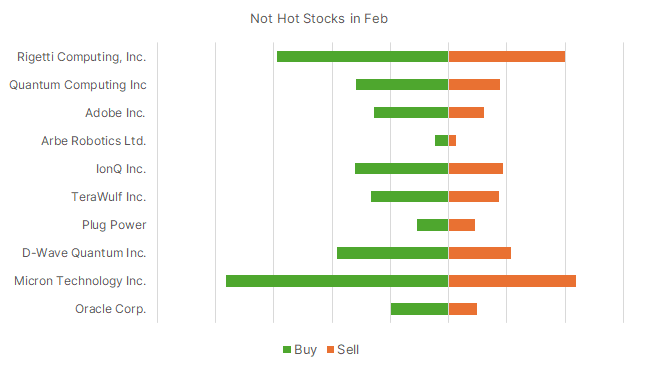

Key takeaways from stocks that lost momentum are as below:

- Tesla’s 28% decline was one of the biggest surprises of the month, as traders lost confidence in its ability to maintain growth.

- Quantum computing hype collapsed – Rigetti Computing (RGTI) and Quantum Computing Inc. (QUBT) saw a huge drop in trading interest.

- Clean energy stocks cooled off – Plug Power and TeraWulf saw trading activity slump, as investors prioritized other growth sectors.

What to Watch in March

Will China’s rally hold up?

Alibaba and Tencent saw a huge trading surge in February—can they sustain their momentum? Watch for the impact of Trump’s tariffs on China, along with China’s policy impact from the NPC.

Is AI infrastructure the new AI trade?

Super Micro Computer dominated February, but some of that had to do with its de-listing risks. Will AI hardware continue to attract traders, or will they rotate elsewhere? Europe? China tech?

How low can Tesla go?

After a brutal 28% drop, is this a buying opportunity or the start of more declines?

Could quantum stocks see a comeback?

More of the big tech companies are talking about quantum computing, even as application remains some way off in the future. Could quantum computing see a comeback after the cooling rally brings a more compelling entry point?

Are gains in European defense stocks sustainable?

Europe is outperforming US year-to-date, and increased defense spending from European companies could bring an outperformance of European defense stocks over US.

March is shaping up to be a big test for AI, China, and Tesla—stay tuned!