Options - Long vs short, assignment, exercise & ‘moneyness’

Level: Beginner / Length: 7 minutes

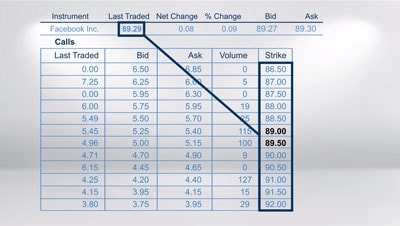

In this module, you’ll learn the difference between being long and being short on an options contract. And, in addition, we’ll explain the process of assignment and exercise and also look at the ‘moneyness’ in an option contract.

An options value is comprised of two elements: Intrinsic and extrinsic value. We’ll show you how this is calculated and what it means to your trading.

And depending whether you bought or sold a contract, the ‘time value’ could work to your disadvantage or advantage. We’ll explain why.

- What does it mean to be long or short?

- The process of alerting your broker to your intent – ‘exercise’

- What is the difference between intrinsic and extrinsic value?

- The differences between ‘in’, ‘out’ and ‘at’ the money

IMPORTANT INFORMATION

The materials published on all Saxo Group websites should not be considered as financial, investment, tax, trading or other advice, or recommendation to invest or disinvest in a particular manner. Saxo assumes no liability for any losses resulting from trading in accordance with a perceived recommendation or reliance on Saxo material. Past performance is not indicative of future results.