Quarterly Outlook

Fixed Income Outlook: Bonds Hit Reset. A New Equilibrium Emerges

Althea Spinozzi

Head of Fixed Income Strategy

Key points:

------------------------------------------------------------------

The Saxo Quick Take is a short, distilled opinion on financial markets with references to key news and events.

Disclaimer: Past performance does not indicate future performance.

In the news:

Macro:

Earnings: Netflix, Blackstone, Intuitive Surgical, TSMC, Infosys, Disco, Axis Bank

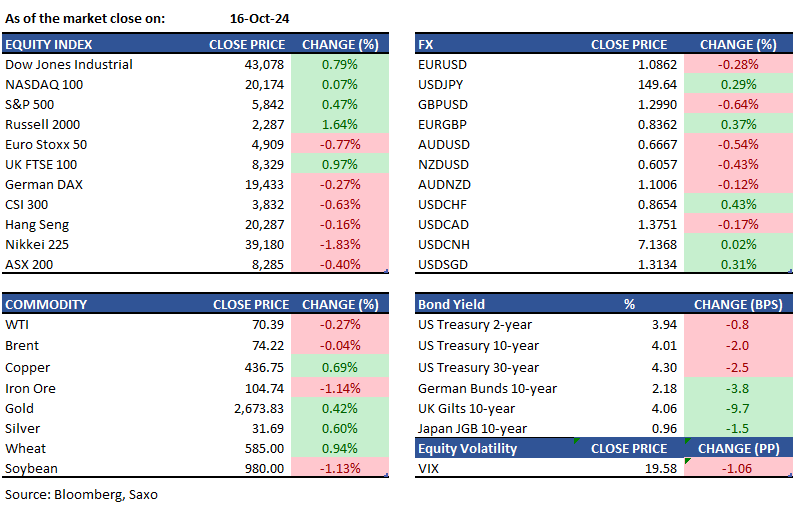

Equities: Stocks in the US ended mostly higher on Wednesday, partially rebounding from the previous session's losses. The S&P 500 rose by 0.5%, the Dow Jones advanced by 337 points to reach a new record high, while the Nasdaq 100 saw a slight gain of 0.1% as the chip sector continues to underperform. Morgan Stanley reported rising 6.5% after surpassing earnings and revenue expectations. Additionally, Abbott gained 1.5% with stronger-than-expected quarterly results. Conversely, Intel declined by 1.4% following a review call from the Chinese cyber association. Nvidia recovered by 3.1% after slumping 4.5% the prior day, influenced by ASML's lowered sales forecast.

Fixed income: Treasuries advanced with the yield curve slightly flattening due to significant block trades. Positive momentum was set following weaker-than-expected UK inflation data for September. Declines in oil prices after Tuesday's selloff further pressured cash yields. US yields had fallen by 1 to 2 basis points across the curve, with the long end outperforming. The US 10-year yield settled around 4.02%, while gilts outperformed by 8 basis points for the day. UK bonds outperformed as traders adjusted expectations for Bank of England policy easing after the CPI data, anticipating a ~24 basis point rate cut next month and ~42 basis points by year-end. Additionally, Japan’s Ministry of Finance announced an auction of ¥400 billion in bonds with maturities of 15.5 to 39 years.

Commodities: Gold continued its upward trend, increasing by 0.42% to reach $2,673, while silver climbed 0.6% to $31.69. This movement aligns with the decline in Treasury yields, benefiting from a slight reduction in risk appetite as markets evaluated the Federal Reserve's policy outlook. Meanwhile, WTI crude oil futures fell by 0.27% to $70.39, and Brent crude edged down by 0.04% to $74.22, following a 4% decline in the previous session amid continued uncertainty over the Middle East conflict. According to the API's Weekly Statistical Bulletin, U.S. crude oil inventories decreased by 1.58 million barrels for the week ending October 11, 2024, following a significant increase of 10.9 million barrels the previous week. This marks the sixth draw in the past eight weeks, contrary to market expectations of a 2.3 million barrel build. Cocoa futures near $7,900 per tonne due to West African flooding, delaying harvest and raising supply concerns.

FX: A Bloomberg index of the dollar climbed to a 10-week high as major currencies, led by the Mexican peso, weakened amid traders' concerns over Donald Trump's tariff plans. The pound fell after a weaker-than-expected UK inflation report, with GBPUSD dropping as much as 0.7% to 1.2980, its lowest since August 20. EURUSD declined by 0.4% to 1.0855, reaching a fresh two-month low and extending its decline for a third consecutive day. Norway's krone led G-10 losses, with USDNOK rising around 1% to 10.9286. NZDUSD fell as much as 0.7% to 0.6040, its lowest level since August 19, before recovering some losses. Additionally, the Australian dollar traded near a five-week low.

For all macro, earnings, and dividend events check Saxo’s calendar.

For a global look at markets – go to Inspiration.

Disclaimer

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Please read our disclaimers:

- Notification on Non-Independent Investment Research (https://www.home.saxo/legal/niird/notification)

- Full disclaimer (https://www.home.saxo/en-gb/legal/disclaimer/saxo-disclaimer)