Quarterly Outlook

Macro outlook: Trump 2.0: Can the US have its cake and eat it, too?

John J. Hardy

Global Head of Macro Strategy

Chief Investment Strategist

The market is navigating a perfect storm of uncertainty. Investors are wrestling with concerns over slowing economic growth, rising tariffs, and geopolitical tensions. Central banks are juggling inflation risks and growth concerns, while companies face margin pressures from supply chain disruptions and wage inflation.

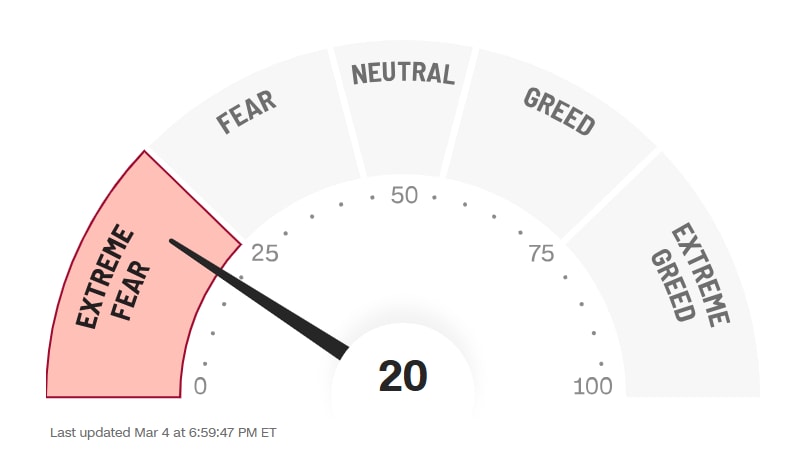

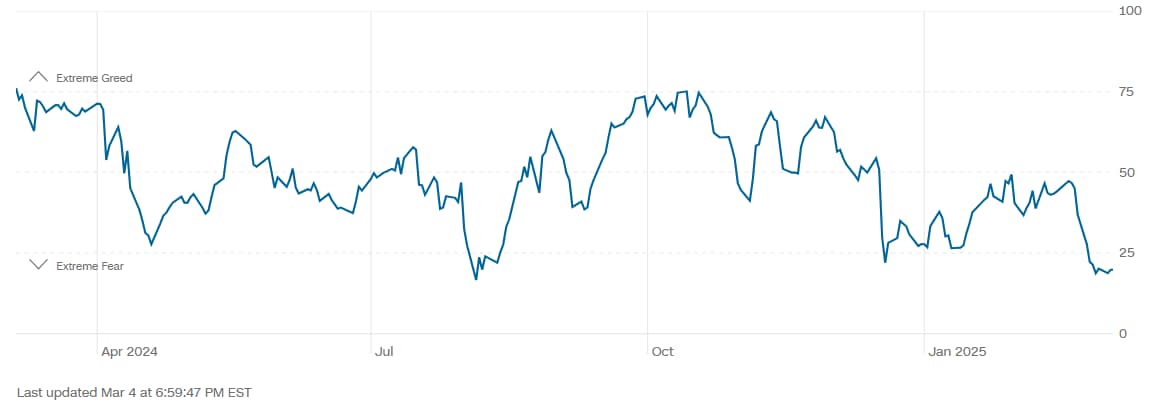

These factors have fueled volatility, leading to a sell-off in stocks. Fear is gripping financial markets, as can be seen from CNN’s Fear and Greed Index below. After dipping to 22 at the end of February, the index had fallen to 20 as of March 4, reflecting deep unease among traders and institutional investors alike.

While market sentiment indicators don’t dictate future price movements, they provide insight into the emotional state of the market – often a contrarian signal for savvy investors. When fear reaches extreme levels, it has historically marked moments of potential opportunity or further market turbulence.

And history has shown that great companies tend to recover, and often come out stronger. For long-term investors, times like these present opportunities to buy quality stocks at a discount.

Despite short-term concerns, several tailwinds could support a market recovery.

While the bull case has its merits, risks remain.

In this environment, a diversified approach is critical. Instead of making aggressive bets on a market bottom, investors should focus on high-quality companies with solid financials and reasonable valuations.

Markets rarely bottom in a straight line, and trying to time the exact turning point is difficult. Instead of waiting for perfect conditions, focusing on time in the market – investing steadily in fundamentally strong companies – has historically been a more effective strategy.

Trying to predict the exact market bottom is nearly impossible. Many investors wait on the sidelines, hoping for more clarity, only to see stocks rebound before they get in. That’s why long-term investors focus on time in the market, not timing the market. Investors who wait for the “perfect” entry point often miss out on some of the best buying opportunities.

Consider this:

With that approach in mind, we used a structured screening process to identify growth stocks that balance strong fundamentals, reasonable valuations, and institutional support.

Given current market conditions, we focused on the following:

Using these filters, we identified the below stocks:

Uncertainty may persist, but long-term investors know that market cycles come and go. Instead of trying to predict the bottom, focus on buying great businesses at reasonable prices and holding them through market fluctuations.

The best opportunities often appear when fear is highest. If you believe in the power of compounding and the resilience of strong businesses, now might be a great time to start building or repositioning your long-term portfolio.